Why Out-of-State Tax Relief Firms Struggle with California Agencies

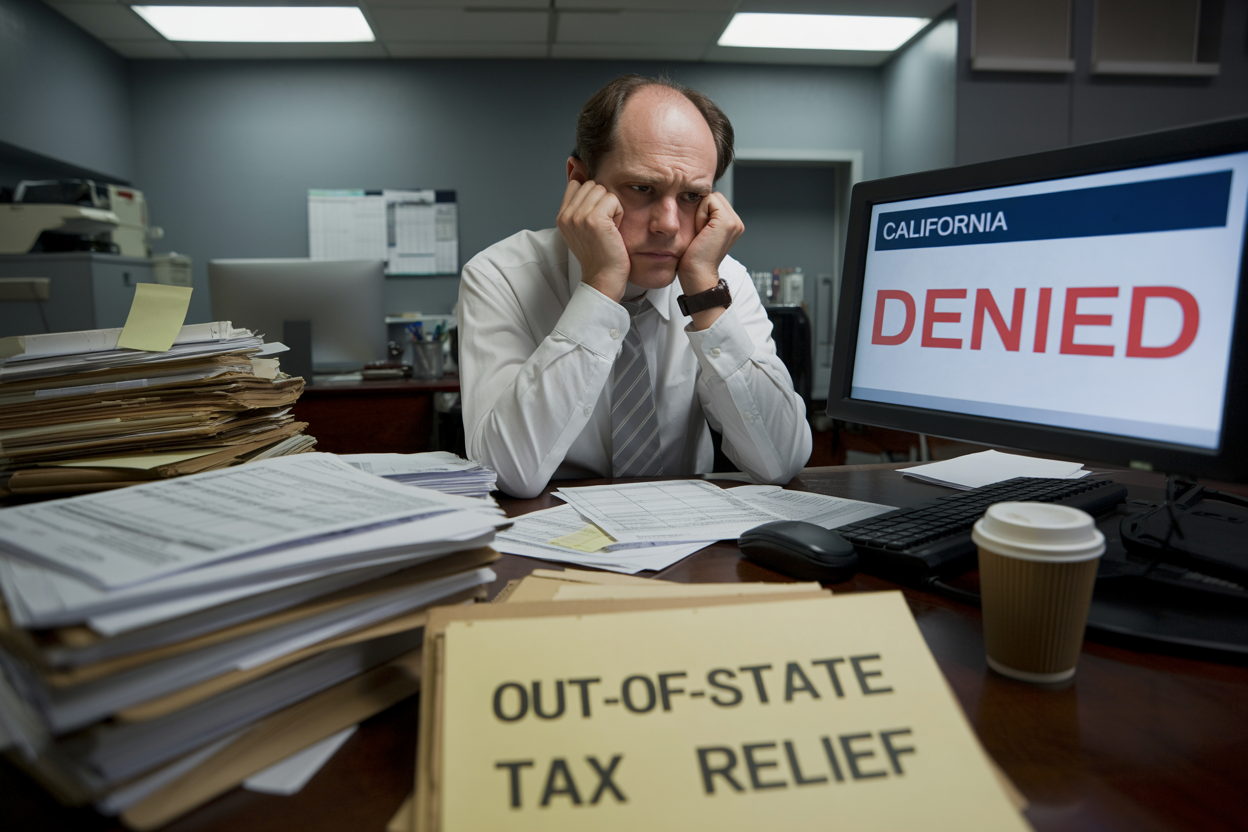

If you’re behind on taxes in California, you might be tempted to call one of those national “tax relief” companies you see on YouTube or Google Ads. They promise to stop IRS collections, settle your tax debt for pennies, and even throw around terms like Offer in Compromise.

But here’s the problem:

Most out-of-state tax relief firms can’t help you with California agencies like the Franchise Tax Board (FTB), CDTFA, or EDD — because they don’t know how California works.

If you live in California or your business is registered here, you need someone who understands the state enforcement landscape — not just the IRS. At Boulanger CPA, we specialize in tax resolution for both federal and California tax agencies.

National Firms vs. California CPAs

Let’s compare how a typical out-of-state tax relief firm stacks up against a local CPA:

| Feature | National Tax Relief Co. | Local CPA (like Boulanger CPA) |

|---|---|---|

| Licensed in California? | ❌ Often not | ✅ Yes — CBA licensed |

| Handles FTB, CDTFA, EDD? | ❌ Rarely | ✅ Daily |

| Understands CA wage garnishment? | ❌ No | ✅ Yes |

| Personalized tax plan? | ❌ One-size-fits-all script | ✅ Based on financials + enforcement risk |

| IRS + State coordination? | ❌ Just IRS | ✅ See how we handle dual IRS + FTB collections |

Why National Firms Fail with California Tax Enforcement

1. They Don’t Handle State-Level Enforcement

Most tax relief companies only know how to file IRS documents — they have no idea what to do if the FTB files a bank levy or the CDTFA hits your business with a sales tax lien.

But we do. See our article on how to stop a tax levy from multiple agencies in California.

2. They Don’t Understand California’s Timelines

IRS collections are slow and bureaucratic. The FTB and CDTFA are faster and more aggressive:

- FTB levies can happen

within 10

days of a notice

- CDTFA assessments become final

after just 30 days

- EDD payroll tax issues often

skip straight to collection

We routinely help clients facing FTB bank levies and CDTFA Notice of Determination deadlines.

3. They Don’t Know California Entity Law

National firms almost never ask:

- Is your LLC

suspended by the FTB?

- Have you failed to pay your

minimum franchise tax?

- Did CDTFA revoke your

seller’s permit?

- Did EDD determine your contractors are employees?

We see it every week: a national firm charges $5,000 to “resolve the IRS,” and the client ends up suspended and still owes the state.

When You Should Choose a Local CPA Instead

You should work with a California CPA — not a call center — if:

- You owe the

FTB or have multiple years of unfiled returns

- Your business was hit with a CDTFA sales tax audit

- You got a wage garnishment from both the

IRS and FTB

- You’ve received a Notice of Determination from the CDTFA

- You want someone to actually

represent you

and defend your rights

What We Do Differently at Boulanger CPA

- We’re licensed in California and IRS-authorized

- We represent clients in

IRS, FTB, CDTFA, and EDD collections

- We file

Offers in Compromise for both state and federal agencies

- We don’t hand your case to a junior — Marc Boulanger, CPA, handles it himself

📞

Don’t risk your financial future with a telemarketer. If you want real resolution, talk to a real CPA.

Frequently Asked Questions

Can national tax relief companies handle FTB or CDTFA issues?

Rarely. Most firms focus only on the IRS and don’t understand California’s aggressive state tax enforcement.

What makes California tax agencies harder to deal with?

Agencies like the FTB and CDTFA move faster, require different forms, and often issue levies with little notice.

What happens if I ignore a CDTFA Notice of Determination?

The tax becomes final in 30 days and you lose your right to appeal. The CDTFA can then levy your bank account or seize assets.

What’s the difference between a CPA and a tax relief company?

A CPA is licensed and held to professional standards. Tax relief companies are often sales-driven and may not even be based in California.

Can a CPA help with both IRS and state tax debt?

Yes. At Boulanger CPA, we coordinate resolutions across the IRS, FTB, CDTFA, and EDD to stop collections and settle tax debt legally.

📣 About the Author

Marc Boulanger, CPA is the founder of Boulanger CPA and Consulting PC, a boutique tax resolution firm based in Orange County, California and trusted by high-income individuals and business owners across Southern California.

He is the author of Defend What’s Yours: A California Taxpayer’s Guide to Beating the IRS and FTB at Their Own Game, available now on Amazon. The book offers a step-by-step plan for resolving IRS and FTB tax debt without losing your business, your home, or your peace of mind.

With over a decade of experience resolving high-stakes IRS and State tax matters, Marc brings strategic insight to complex cases involving wage garnishments, bank levies, unfiled returns, and six-figure tax debts. He is known for helping clients reduce or eliminate tax liabilities through expertly negotiated settlements and compliance plans.

Marc is a Certified Public Accountant licensed in California and Oklahoma and holds the designation of Certified Tax Representation Consultant. He is a member of the American Society of Tax Problem Solvers (ASTPS) — the national organization founded by the educators and practitioners who have trained thousands of CPAs, EAs, and tax attorneys in IRS representation strategy.

Every case is handled with discretion, proven methodology, and direct CPA-led representation — not call center scripts.

📍 Learn more at www.orangecounty.cpa or call (657) 218-5700.